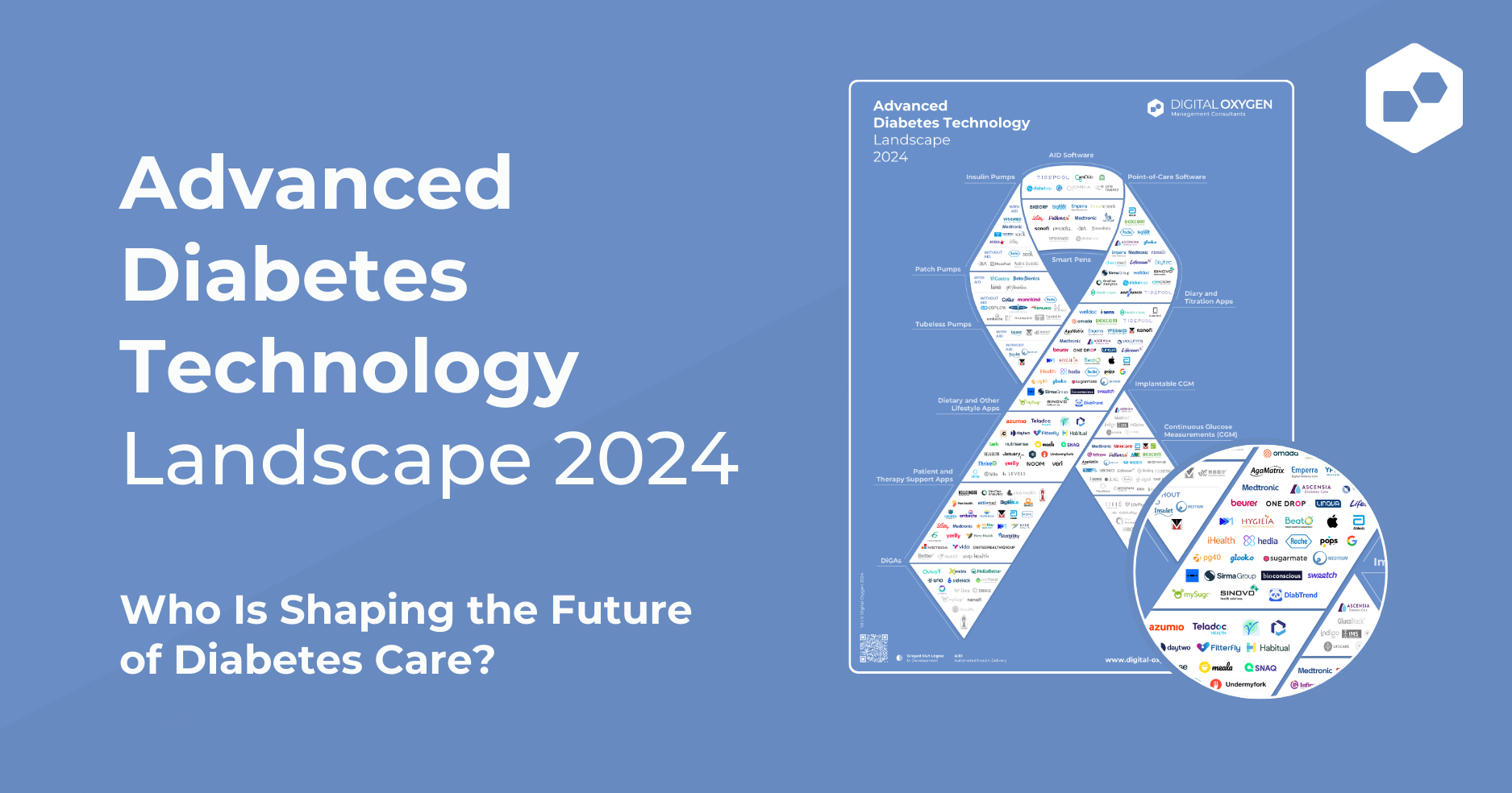

Advanced Diabetes Technology Landscape 2024

Who Is Driving the Evolution of Diabetes Care Technology?

Digital Oxygen once again presents its comprehensive overview of the companies shaping the future of Advanced Diabetes Care. In our 2024 edition of the Advanced Diabetes Technology Landscape, we have gathered more than 250 companies that are currently or will be influencing Diabetes Care – an increase of 25% vs. 2023. Our Landscape offers structured insights into technology firms operating in the area of advanced Diabetes Care. We have categorized the market into 13 segments, encompassing insulin pump manufacturers, CGM sensor developers, apps tailored for patients and healthcare professionals, as well as AID software. This year’s Landscape includes again manufacturers of DiGAs (Digital Health Applications, reimbursed in the German market) as this new therapy option becomes more and more established in the German Health Care system. Key highlights from the Advanced Diabetes Technology Landscape 2024:

- AID emerges as the standard: Automated Insulin Delivery (AID) facilitates the automated insulin delivery for patients. As predicted already last year, this technology has gained significant traction and is settled to be the new norm in pump-supported diabetes therapy.

- Dynamics in non-invasive measurement: Apple and Samsung are among those companies announcing soon-to-be breakthroughs in non-invasive blood glucose measurement. Some companies did disappear of the course of the year, but others newly joined the group of companies developing non-invasive measurement solutions. Still, the Landscape indicates substantial growth in this domain compared to the previous year, albeit again with no products launched yet.

- Fastest growing segment is CGM: The CGM market is still dominated by the 3 market leaders Abbott, Dexcom and Medtronic. But new players have been entering the market already and even more companies are planning to introduce a CGM sensor in the near future – adding up to more than 20 companies in that segment.

While patients are appreciating the array of new products supporting their daily diabetes management, it presents a challenge for healthcare providers. They must ensure they provide the right recommendations and adequately train their patients. This might represent an opportunity for the technology companies taking over more responsibility for the technical training to unburdening the HCPs and strengthening their patient relationships. The increased competition in many segments will also benefit the health care systems as prices will go down for many devices – at the same time making advanced technology more affordable for new diabetes patient segments. “The institution of AID software in day-to-day therapy and the availability of cheaper CGM sensors will probably be a catalyst for the establishment of SMART Pens bringing the benefits of advanced diabetes technology to the vast majority of type-2 patients.”, predicts Torsten Christann, Managing Partner at Digital Oxygen.

The Landscape categorizes over 250 companies into 13 categories, including:

- Pumps

- Traditional Insulin Pumps

- Patch Pumps

- Tubeless Pumps

- Smart Pens

- Advanced Blood Glucose Measurement

- Continuous Glucose Monitoring (CGM)

- Implantable CGM

- Non-Invasive Measurement

- Apps and Software

- AID Software (Automated Insulin Delivery)

- Point-of-Care-Software

- Diary and Titration Apps

- Dietary and Lifestyle Apps

- Patient and Therapy Support Apps

- DiGA (Digital Health Applications)

Free Download

Please complete the following data to download the Advanced Diabetes Technology Landscape 2024.

Get the Print

You can also order a print of the Advanced Diabetes Technology Landscape 2024.

Your Contact

Torsten Christann

Managing Partner